Enovix Stock: The Future of Battery Innovation and Why Investors Are Watching Closely

Introduction: Enovix The Company That Changing the Battery Game

In the fast-paced world of technology, where energy efficiency and innovation drive everything from smartphones to electric vehicles, Enovix Corporation (NASDAQ: ENVX) has emerged as a company worth watching. Enovix isn’t just another battery manufacturer—it’s a technology pioneer aiming to revolutionize how lithium-ion batteries are designed and used.

Founded in 2007 and headquartered in Fremont, California, Enovix Stock focuses on advanced 3D silicon lithium-ion batteries, which offer higher energy density, faster charging, and greater safety compared to traditional graphite-based batteries. This breakthrough could mean more power in smaller devices, longer-lasting electric vehicles, and even safer wearable tech.

Naturally, this technological edge has caught the attention of investors, analysts, and major tech players. But what exactly makes Enovix stock such a buzzworthy investment? Let’s break down everything you need to know—from its core innovation to financial performance, growth prospects, and market potential.

The Technology Behind Enovix: What Sets It Apart

Enovix Stock When you think of lithium-ion batteries, you probably picture the standard flat or cylindrical cells used in laptops, smartphones, and EVs. These have been around for decades—and while improvements have been made, traditional battery design still faces limitations, especially with energy density and thermal safety.

Enovix’s breakthrough lies in its 3D cell architecture. Instead of using the usual “jelly roll” battery structure, Enovix builds a stacked 3D design that allows for more silicon in the anode. Silicon can store more lithium than graphite, which translates into greater energy capacity. The result? Smaller batteries that last longer and charge faster.

Moreover, Enovix incorporates mechanical constraint systems to reduce swelling—a common issue with silicon anodes—and improve safety during charging. This design gives Enovix Stock ovix a unique advantage in the race for better battery tech. As industries move toward electrification, from smartphones to electric vehicles, the company’s innovation could redefine what’s possible in portable power.

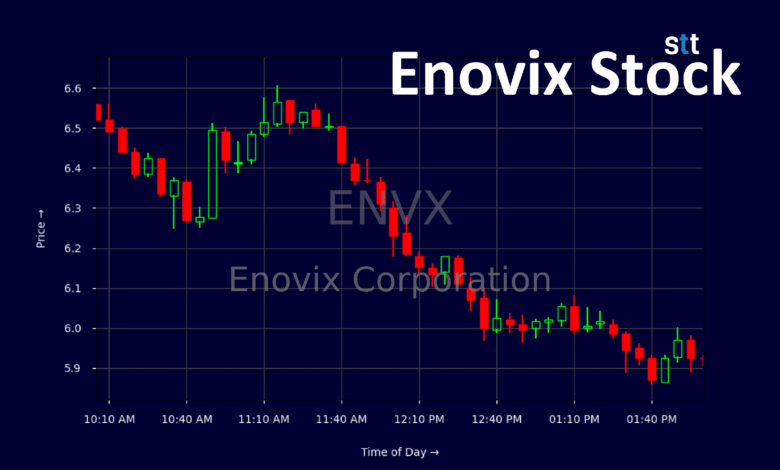

Enovix Stock Performance: The Ups and Downs

Like many growth-oriented tech companies, Enovix Stock journey has been anything but smooth. After going public via a SPAC merger in 2021, ENVX stock initially attracted strong investor enthusiasm. The promise of game-changing battery technology had everyone—from retail investors to institutional analysts—betting on big future potential.

However, reality soon set in. Enovix Stock faced production challenges, particularly scaling up manufacturing efficiently. As a result, the stock price saw fluctuations, reflecting both the optimism about its technology and the skepticism around execution risks. Investors began to question whether Enovix could move from prototype brilliance to commercial success.

In recent months, though, Enovix Stock has shown encouraging progress. The company’s Fab-2 manufacturing facility in Malaysia is a key milestone in scaling production, signaling its commitment to moving from R&D to real-world application. These operational improvements have helped stabilize investor confidence, and many analysts believe the worst of the volatility may be behind the company—at least for now.

Market Potential: Why Enovix Batteries Could Be Game-Changers

The global battery market is booming. With the rise of electric vehicles (EVs), renewable energy storage, and high-performance portable electronics, demand for advanced battery technology is at an all-time high. According to market research, the lithium-ion battery market could exceed $150 billion by 2030, and companies that innovate early stand to capture significant value.

Enovix’s batteries are particularly promising for consumer electronics and wearable tech. Devices like smartwatches, AR/VR headsets, and medical sensors all need compact batteries that last longer without overheating. This is exactly where Enovix shines.

In the long term, Enovix Stock also plans to target electric vehicle applications—a much larger market. While this will require further scaling and possibly partnerships with automotive giants, even a small slice of the EV battery market could translate into substantial revenue. As sustainability and electrification trends accelerate globally, Enovix’s 3D cell technology gives it a strong competitive edge.

Leadership and Strategic Partnerships

One of the biggest strengths behind Enovix Stock progress is its leadership team. Under the guidance of CEO Dr. Raj Talluri, who has decades of experience in the semiconductor and tech industries (including roles at Qualcomm and Micron), Enovix has taken a focused approach to balancing innovation with business strategy.

Dr. Talluri’s emphasis on manufacturing scalability and commercial readiness marks a shift from the early years when the company was primarily a research-driven operation. His goal is clear: to move Enovix from promising prototypes to mass production without compromising quality or innovation.

Additionally, Enovix Stock has formed key strategic partnerships with consumer electronics brands and defense contractors. These partnerships not only validate its technology but also provide early revenue opportunities. As more large-scale contracts roll in, Enovix could see its growth accelerate rapidly.

Financial Overview: Where Things Stand

Financially, Enovix is still in the growth and investment stage, meaning it’s not yet consistently profitable. The company has reported revenue in the low millions, which is expected for a firm still ramping up production capacity. What investors are watching closely, however, is the company’s burn rate and cash reserves.

Enovix has taken proactive steps to manage its finances, including securing additional funding to support expansion. With the Malaysia Fab-2 plant nearing completion and more potential customers in the pipeline, Enovix’s financial trajectory could shift favorably once large-scale deliveries begin.

Analysts are split: some see Enovix as a long-term growth stock, betting on the inevitable rise of silicon-anode batteries. Others remain cautious, pointing to manufacturing complexities and the competitive nature of the battery industry. Either way, Enovix’s financial performance in the next few quarters will likely determine its next major move on Wall Street.

Risks and Challenges: What Investors Should Know

No investment is without risk, and Enovix stock is no exception. The company’s biggest challenge remains scaling up production efficiently while maintaining product quality and safety. The transition from prototype success to full-scale manufacturing is where many battery startups stumble.

Additionally, Enovix faces tough competition from established players like Panasonic, Samsung SDI, and CATL, all of which have far larger resources and established customer networks. To succeed, Enovix must continue to innovate and find niche markets where its unique technology offers a distinct advantage.

Another risk involves market timing. If demand for its target applications (like wearables or EV batteries) slows or shifts toward competing technologies, Enovix could face delays in profitability. Therefore, investors should view ENVX stock as a long-term bet—one that could take several years to fully pay off.

Future Outlook: Why Enovix Still Holds Massive Potential

Despite the challenges, the future for Enovix looks bright. The company’s cutting-edge battery technology, combined with strong leadership and expanding production capacity, positions it well to capture a share of multiple fast-growing markets.

If Enovix successfully executes its roadmap, it could become a major player in next-generation energy storage. Its silicon-anode technology might not just improve consumer devices but also power critical applications like drones, defense equipment, and electric transportation.

Investors who can handle some volatility and are willing to hold long-term may find Enovix stock an appealing addition to a growth-focused portfolio. The key will be patience—this is not a quick flip but a potential future giant in the making.

Conclusion: Enovix Stock A Risk Worth Considering

Enovix represents the perfect mix of high innovation and high potential, with just enough risk to keep things interesting. Its revolutionary approach to battery design, led by experienced management and supported by strong partnerships, sets it apart in a crowded market.

While it’s still early in the company’s commercial journey, the progress so far is promising. If Enovix can scale production smoothly and secure major contracts, its stock could deliver significant long-term rewards.

In short, Enovix stock isn’t just about investing in a company it’s about investing in the future of energy itself. With the world demanding smarter, safer, and more powerful batteries, Enovix might just be the spark that powers the next wave of technological progress.